Bandhan may lose its small loan focus after becoming a bank: Muhammad Yunus' Interview with Live Mint

Muhammad Yunus | Bandhan may lose its small loan focus after becoming a bank

The Nobel laureate and founder of microfinance pioneer Bangladesh’s Grameen Bank says MFIs in India could be greedy and tapping the capital market or raising loans from private equity funds is a bad idea

Mumbai: Muhammad Yunus , Nobel laureate and founder of microfinance pioneer Bangladesh’s Grameen Bank, said it is doubtful whether India’s largest microfinance institution (MFI) Bandhan Financial Services Pvt. Ltd will be able to continue its focus on small loans after it becomes a bank. Last year, Bandhan became the first MFI in the country to win a bank licence.

Mumbai: Muhammad Yunus , Nobel laureate and founder of microfinance pioneer Bangladesh’s Grameen Bank, said it is doubtful whether India’s largest microfinance institution (MFI) Bandhan Financial Services Pvt. Ltd will be able to continue its focus on small loans after it becomes a bank. Last year, Bandhan became the first MFI in the country to win a bank licence.

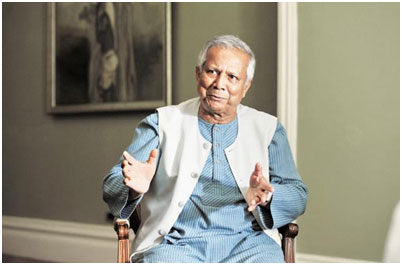

Muhammad Yunus says there is a need to create laws that allow lenders to the poor to be separate banks. Photo: S. Kumar/Mint

A bank is like a supertanker that cannot fish like a dinghy in shallow water, he said. MFIs in India could be greedy and tapping the capital market or raising loans from private equity funds is a bad idea, Yunus said in an interview. He spoke after a day-long dialogue with the who’s who of India’s conglomerates and intelligentsia, organized by law firm Nishith Desai Associates on 14 March. Edited excerpts:

What is a social business model?

When you talk about business, people immediately think it is got to do with money-making. Business and profit-making are bundled up and hard to disassociate because our theory says so. I was trying to solve the problem of poverty in a village through microcredit, and every time I tried to address a problem, my natural instinct was why not create a business? So I began doing that. The alternative was to bring some charity to them, but I saw the limitation of it, as I would need a fresh round of money to do the same thing. Here business means providing a service or a product for people to buy. Through that you cover your cost, making it sustainable. But I’m not interested in making money. I’m interested in solving problems in a sustainable way. So I defined it as a social business, which will help solve human problems. Investors can take back the investment, but they won’t get any dividends.

Will social business eventually replace the traditional way of doing business?

It is up to us to decide. The capitalist system didn’t give us any option. Money-making has become an addiction for us and we have become profit chasers. The capitalist way interpreted human beings as a selfish being. That’s a wrong interpretation. We are not money-chasing robots. The real interpretation of a human is not so single-dimensional. Yes, we are selfish, but at the same time we are selfless. That selflessness is not included in the economic theory. They said if you want to be selfless, go ahead and be a philanthropist. I’m saying can we be selfless and have a business? If making money is happiness, making others happy is super-happiness.

We have seen capitalism, socialism and communism. Is this a new kind of ism?

Capitalism made a mistake. While the theory is okay, it misinterprets humans. If you reinterpret humans as a multidimensional being, you have rules for all options. I am giving an option for capitalism to reinterpret humans. But it still follows the market, freedom and still believes in entrepreneurship. Capitalism was standing on one foot, I’m adding another leg. It is a generous form of capitalism.

Is it not possible to earn dividends, make huge profits and be selfless at the same time?

Sure. You could mix both and get a variety of businesses, some little selfish, some more selfish, you can do that. But when you mix profit-making and social, you do less of both.

For example, this is a non-smoking room. And someone says why can’t we have one puff (analogy for profit) in a non-smoking room, so if you allow that, then logic tells you it is a one-puff room, one-cigarette room, and then you have a one packet room, and you have to make arrangements for them all. When you say non-smoking, you can forget about smoking.

In India, it is mandatory for companies to allocate 2% of their profit on CSR (corporate social responsibility) activities. While NGOs and trusts can be recipients of CSR funds, social ventures have been excluded. How big a loss is this?

It is a great idea to mandate CSR spending. The original draft had included social ventures. We had discussed it, but by the time it came to the floor for the bill to be passed, it disappeared. I think the word business made it unattractive. If it is not included, it is a big loss because if you put even half the money into social business, then you can compare how powerful this is compared with the other half. Companies themselves may be interested in getting into social business. When companies enter social business with all their creative energy, it will become very powerful. However, Nishith (Desai) told me he is going to challenge its exclusion. I think the fear is, if it is social business, will they start making money for themselves? So you need a regulator to oversee it.

One of our biggest MFI, Bandhan is becoming a bank. Do you think that should be the natural progression for an MFI? Grameen also became a bank.

Grameen started as a bank, it did not become a bank. Grameen Bank law is not the standard banking law. Standard banking law creates banks for the rich, you cannot create a bank for the poor with that law. Banking law is an architecture for a long haul supertanker ship. But microcredit in that sense is a dinghy. Bandhan doesn’t have a dedicated law, so they went to the supertanker route and created a bank. They said we will use this supertanker and carry the work of little things. But supertanker goes in deep ocean and go long distances, while dinghies operate in shallow water. MFIs go in rural, semi-urban places. Although your motive was right, sooner or later you will feel the pinch. Because the law will tell you what you can do and what you can’t do. After becoming a bank, you may have to take collateral. Poor borrowers will tell you they don’t have collateral, but now that you are a bank, without collateral the law prohibits you from lending.

Secondly, even if you are doing a good job in microcredit, someone may say why don’t you give a million-dollar loan to a big company? You have the licence to do it! At the moment you may not be looking into such a possibility, but sooner or later, some expert will advise you about such big opportunities. You will start with just one big loan and gradually microcredit will become your token activity. I am not saying it will happen, but this is the danger. The Bandhan team is a set of very dedicated people, I know them well. So far it is OK, but the possibility of deviating from the goal is always there.

What do you recommend?

I would say, create a new law and allow bankers to the poor to be separate banks. You may call it microfinance banks. They can then take deposits. Because if they can’t take deposits, they have to get foreign money. SKS (Microfinance Ltd) created the problem and said we will have to now bring money. Without money, we will have to go to the capital market. Absolutely wrong idea. Grameen Bank never went to the capital market or the big guys to ask for money. We just take deposits and lend money, just like any other bank. That’s why India’s MFI industry is still small, compared with the need.

Is it because of the companies themselves or the law that has prohibited MFI growth in India?

It is important you create laws to help them become microfinance banks and accept deposits. It is risky for them to become a full-fledged bank. Giving banking licence could be an interim solution, but not a permanent solution to serve the poor. Because commercial banking and microcredit banking are not the same.

What is your assessment of the Indian MFI industry?

They went through a lot of trauma because of SKS and so on. It was a good thing to have happened, because the industry was slowly moving in that direction. People forgot what is microcredit and what is not. Malegam committee made very good recommendations and RBI took action. I am very delighted that now there is a cap of 24% on lending rate. Many people criticized it, but in microcredit you need to have a cap. They may say remove the cap and we will behave well, but whenever they get little opportunity, they will begin all sorts of activities.

But again, these are interim solutions. The real solution is to create a law. There is a pending legislation in Parliament, and that is an opportunity. The MFI bill is not a good bill. Now that you have the opportunity, why don’t you create a bill that creates a new kind of microcredit bank.

That way we have already introduced payments banks.

But they cannot take deposits. That’s the key! Lending is easy, but who is giving you the money to pay? If I can take deposits, I am on my two legs, otherwise I am on one leg.

The government is opening bank accounts for all families with a proposal of an overdraft facility of Rs. 5,000 per account. Also there are micro-pension and micro-insurance. How far do you think this will help in inclusion?

Account in itself does not mean anything. A bank will not like to operate such small accounts, but the government has said so it has to be done. However, the fact that the subsidies will go directly to the accounts, linked to Aadhaar card, is an excellent idea. But if you just put some money in it and leave the account as it is, the account holder will come and take the money as a gift and will never come back.

Pension and insurance are very important.

What are the changes that you have seen in India in the social venture scenario?

The word has spread, but it has not turned out the way we would like to see the social business. Social impact and entrepreneurship are gaining importance, but once 20-50 examples are created, it will start getting a hold.

How are developed countries tackling social business?

In poor countries, the immediate problem could be of one kind, but in developed countries the problem can be something else. For example, the welfare schemes in developed nations: I think it is a big problem for them. People don’t have a job, so society comes up to the government and every month the government gives them a cheque. Many have nice houses, a car, television sets, but they are on welfare. So what you have done is that you are hiding poverty by pouring in money with a cheque. How long should you carry on with this welfare with this family? In Europe, four to six generations are in welfare. I say you destroyed those people. You took away the basic human quality, that is to do things to take care of myself and others. You have now created a human zoo. You take care of them, their healthcare, their food...they forgot who they are! It is an unnatural circumstance.

That’s not what welfare should be. It should be a temporary phenomenon, where the government should give them money to make sure that they can get out of it. I said I can create a social business here. My model would be to take five people out of welfare. For example, I may set up a pizza shop and train these people to run it. I will tell them to run it, cover the cost and I will invest in it. And when you give me my money back, I can put that money in another such business. Thus I take care of 10 welfare people. To say it cannot be done is not true.

Youth unemployment in Spain is 40%, in Italy overall it is 40%, you go to south, it is 60%, in Greece it is 70%. That’s crazy. The technologically oriented, educated young are not doing anything. You call this a developed country? You are ruining your young people. And now they talk about a lost generation. What do you mean? You use it so easily...this is their life!

We assume that human beings are workers. Human beings are not born as workers, human beings are go-getters and entrepreneurs. But you have created institutions of them, that’s why they have become unemployed.

“Bandhan may lose its small loan focus after becoming a bank”: Muhammad Yunus’s Interview with Live Mint

By: Live Mint

Published Date: Tue, Mar 17 2015. 01 20 AM IST

Source: http://www.livemint.com/Industry/xNVBrI9DHFUiiEjBHnRdmL/Muhammad-Yunus--Bandhan-may-lose-its-small-loan-focus-after.html

Related Contents

World's growing inequality is 'ticking time bomb': Nobel laureate Yunus

Published Date: Wed Nov 30, 2016Published By: ReutersSource: http://www.reuters.com/article/us-women...

Existing banks serve to rich, not to poor people

Published by: The AsiaNPublished Date: 24 November, 2016Prof. Muhammad Yunus is an extraordinary per...

The Greatest Happiness of Muhammad Yunus or: Throw Out the Old System

Solving Human ProblemsIn his four-decade journey from microfinance to social business, 75-year...

Paving the Way Out of Poverty

Published by: TimePublished Date: 13 October, 2006By Ishaan Tharoor As the proverb goes, M...

Interview with Muhammad Yunus : his vision of social business

Published on - August 7, 2014 Muhammad Yunus, Nobel Peace Prize (2006), sometimes called the "banke...

An Interview with the 'Banker to the Poor' Muhammad Yunus

Published on - March 13, 2010This week I interviewed a banker who only lends money to people w...

Catching Up with Professor Muhammad Yunus

Published on - March 11, 2015 At the 17th Microcredit Summit in Merida, Mexico, Gra...

Micro-Credit and Alleviating Poverty in Bangladesh

Professor Muhammad Yunus is the managing director and founder of Grameen Bank, which currently ope...

Professor Muhammad Yunus on the Power of Social Business

Published on - November 06, 2013 What, in your words, is a social business? The quicke...

Interview with Muhammad Yunus

Caroline Hartnell Published on - 15 September 2015 Pioneering anti-poverty practitione...